A few years back, setting up a corporation for entrepreneurs in the Philippines seemed like a tedious and impractical business decision, especially for the MSMEs – Micro, Small and Medium-Sized Enterprises.

But since the One Person Corporation was introduced as part of the Republic Act 11232 or the Revised Corporation Code in February 2019, single proprietors can now form a corporation without a board of directors or high capital investment.

If you are an entrepreneur aiming to incorporate your business in the Philippines, this article will help you know more about this new business structure and determine if this is right for you.

What Is A One Person Corporation (OPC) In The Philippines?

Simply put, OPC is a new type of business structure enabling individuals to be the sole stockholder, as opposed to the traditional requirement of having at least two to fifteen incorporators.

If you are interested to know more about OPC and its difference from the traditional corporation, the full details are here in this article.

Who Can Form An OPC In The Philippines?

You can form an OPC if you are;

- A natural person of legal age

- Trust

- Estate

A foreign natural person may also set up an OPC in the Philippines but is subject to the applicable capital requirement and constitutional and statutory restrictions on foreign participation in certain investment areas and activities.

Who Cannot Form An OPC In The Philippines?

According to section 14 of SEC’s Memorandum Circular no. 7 series of 2019, the following entities are prohibited to form an OPC:

- Banks, non-bank financial institutions, and quasi-banks

- Pre-need, trust, and insurance companies

- Public and publicly-listed companies

- Non-chartered Government-Owned and Controlled Corporations (GOCCs)

Although a natural person is allowed to set up an OPC, if they are licensed to exercise a profession like Law, Engineering, or Medicine, they are not entitled to form one while in practice, unless provided by special laws.

How Does An OPC Operate?

Under the OPC, the single incorporator shall be its Sole Director and President. All business decisions are made solely by them.

Although it is a one-person corporation, a sole incorporator still needs to appoint non-stakeholders such as Corporate Secretary and Treasurer (if the stakeholder is not a self-appointed treasurer) within 15 days after the issuance of the Certificate of Corporation.

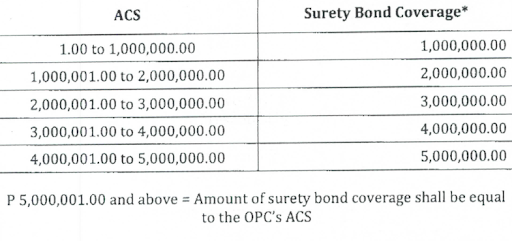

Note that the single proprietor is not allowed to be the Corporate Secretary, but they may assume the role of a Treasurer. If the incorporator assumes this role, they will need to provide a surety bond computed based on the authorized capital stock.

The single stockholder will be required to assign a nominee and an alternate nominee in the Articles of incorporation. The assigned individuals will replace the sole stakeholder in the event of their death and/or incapacity.

The OPC is not required to have a minimum authorized capital stock unless compelled by special laws.

Likewise, the OPC is not required to pay up a portion of the declared and authorized capital at the time of incorporation.

How Can I Register As OPC In the Philippines?

In March 2020, SEC released a notice regarding the online registration of OPC during the pandemic:

“Relative to the implementation of the Enhanced Community Quarantine in Luzon, the Commission has set up an interim online registration system to facilitate application for registration of One Person Corporations (OPC).”

But before the COVID-19 pandemic, below are the steps to register an OPC in the Philippines:

- Submit your proposed company name to SEC. If the name gets rejected because it is no longer available or for any other reasons, you may submit a letter of appeal. Note: All company names under OPC should include “OPC.”

- File your documents to SEC as part of pre-processing.

- Pay the declared fees and submit all hard-copied documents with signature and notarization.

- Wait for the Certificate of Registration from SEC.

What Are The Requirements To Register As OPC?

The OPC must submit the following documents within SEC’s required deadline:

Articles of Incorporation such as:

- Name of Corporation, including the “OPC”

- Name and other details of the Sole stakeholder

- Nominee and alternate Nominee

- Tax Identification Number and Passport

Reportorial Requirements such as:

- Annual audited financial statements within 120 days from the end of its fiscal year as indicated in its Articles of Incorporation. If the total assets or liabilities of the incorporation are less than six hundred thousand pesos (P600,00), the financial statements shall be certified under oath by the corporation’s treasurer.

- A report on all explanations or comments by the president on the qualification, reservation, or adverse remarks made by the auditor in the financial statements

- A disclosure of all self-dealing and related party transactions entered into between the OPC and the single stakeholder

Other requirements (applicable on a case to case basis)

- Letter of appeal – In case the desired company name is rejected by SEC.

- Foreign Investments Act Application Form (FIA) – for foreign natural persons

- Authority to Act on Behalf of the Estate or Trust – Authorization letter, affidavit, or power of attorney.

What’s The Tax Rate Of A One Person Corporation In The Philippines?

One of the disadvantages of an OPC, similar to a regular corporation, is being subjected to a 30% flat income tax—a much higher rate compared to a single proprietary business.

What Are The Opportunities For BPOs?

The Philippines is one of the premier locations of outsourcing companies, and the implementation of OPC in the country opened a trove of employment opportunities for the gig/freelance community.

This type of business structure seemed to be the perfect method for entrepreneurs to enter the business market as it allows an individual to form their BPO corporation to supply and outsource services legally without needing to form a board of directors and pay minimum capital stock.

Foreign entrepreneurs can also set up a BPO in the country as BPOs can be 100% owned by foreigners because it is not part of the Foreign Investment Negative List (FINL).

This opportunity not only benefits the aspiring entrepreneurs, but also the freelancers who want to enjoy the PH Government’s mandatory benefits such as SSS, Philhealth, and PAG-IBIG.

BPO companies under OPC in the Philippines:

- EC Solutions BPO, OPC

- CC Solutions OPC

- Intelsify BPO OPC Operating

- Amana BPO OPC

- Global Business Outsourcing, OPC

Final Thoughts

Registering your business as an OPC is overwhelming, confusing, and can cost you a hefty amount if done incorrectly.

BAMA Law Firm offers legal services to help you go through the business registration process conveniently.

Email us at [email protected] or set an appointment here.